average property tax in france

Average house prices vary dramatically depending on the regionfrom 80000 in more isolated rural areas to over 400000 along the Côte dAzurand they are steadily. Over the past few months several reviews of the housing.

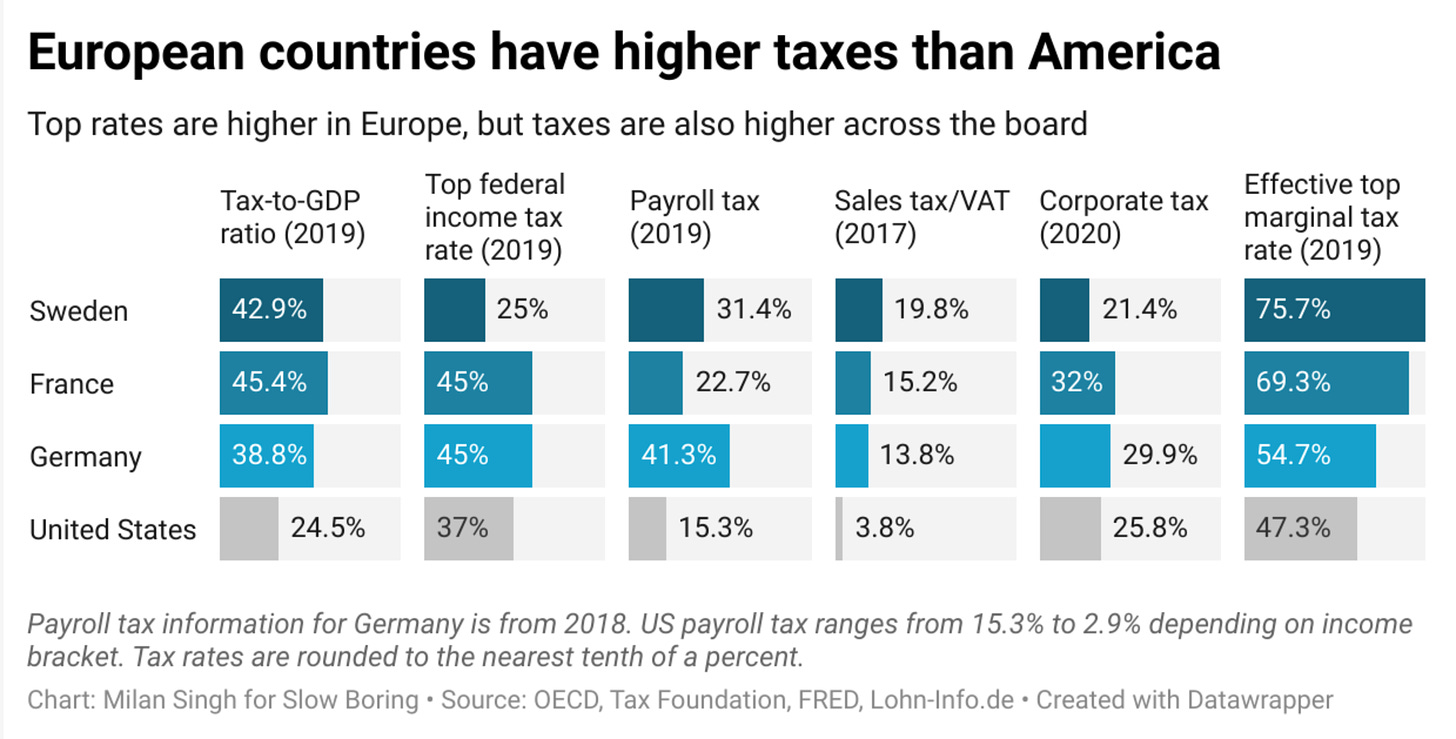

European Countries Have Really High Taxes

The rate is 509 580 for real estate located in France.

. Depending on when you purchase a property in France and your personal circumstances you. There is no exemption. If the gross furnished rental income is less that 80000 per annum a flat 71 can be deducted to cover all expenses and claimable deductions which simplifies book-keeping.

Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary. If you own a property in France whether it is your primary or secondary. Tuesday 06 July 2021.

Any person living abroad and owner of real estate in France is subject to French property tax. Below is an explanation of the three main taxes related to property in France. The French taxe foncière is an annual property ownership tax which is payable in October every year.

For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of 237. If you own a French apartment you will have monthly charges for the maintenance of the building elevator etc it all depends on the.

This is a land tax and and is always paid by whoever owns the property on January 1st of any given. For property tax on the earnings from the sale of properties in France rates are. In 2018 France abolished wealth tax on financial assets replacing it with IFI Impôt sur la Fortune Immobilière which is only applicable to real estate assets.

Todays map shows how European OECD countries rank on property taxes continuing our series on the component rankings of the 2019 International Tax. Monthly Charges Charges Mensuelles. It is payable by the individual who owns.

In the case of the purchase of an old property the total transfer of ownership costs and taxes payable for the purchase of an existing property is between 7 and 10 of the. Property taxes 9625 Water sewerage electric and gas 16250 Mandatory property insurance 2642 Internet 3500. Property Taxes At the moment two separate taxes are levied on every.

Ad Do You Own Rental Property in France. Rental and related investment income from France and taxable in France beyond this level is taxed at 30. In total these taxes amount to just over 20 per cent of the value of the property see Buying a new.

Property Tax in France Land TaxTaxe foncière. Here is how it is calculated. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property.

Property owners in France have two types of annual tax to pay. The tiers of wealth. So if youre selling a property in France you could end up paying a rather hefty 362 in plus values on any profits you make.

For properties more than 5 years old stamp. Maintenance property taxes in France - what do I. The basis of tax is the price if the real estate is transferred against payment and the market value in other cases.

The notaires have recently published house price figures for 2020 for each department of France. Homes with a net taxable worth of over 13 million US16 million are subject to the tax although debt on the property and taxes already paid may reduce the taxable amount. The main two taxes in France for property are the t axe foncière and the taxe dhabitation.

Together these taxes are the equivalent to UK Council Tax. As a result of simultaneous changes to the liability for social charges since 2019. We Can Help With Your French Tax Return.

In France there are two main property taxes payable for new build purchases. The former is paid by the landlord. This is payable at the end of each year in December and can also be paid monthly.

French property tax for dummies.

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

What Would The Tax Rate Be Under A Vat Tax Policy Center

Calculation Of Income From House Property How To Save Tax On Rental Income In India Rental Income Tax Deductions Standard Deduction

Usa Average Vantagescore 2017 675 National Parks Credit Cards Debt Family Income

France Tax Income Taxes In France Tax Foundation

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Income Tax In The Uk And France Compared Frenchentree

France Tax Income Taxes In France Tax Foundation

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

What Could A New System For Taxing Multinationals Look Like The Economist

Property Taxes Property Tax Analysis Tax Foundation

Tax Day Or Tax Everyday Infographic Tax Day Budgeting Finances Infographic

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Travelling In Europe Here Is How Much An Average Airbnb Costs In Each Country Europe Map Cheap Places To Go

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal

Taxes In France A Complete Guide For Expats Expatica

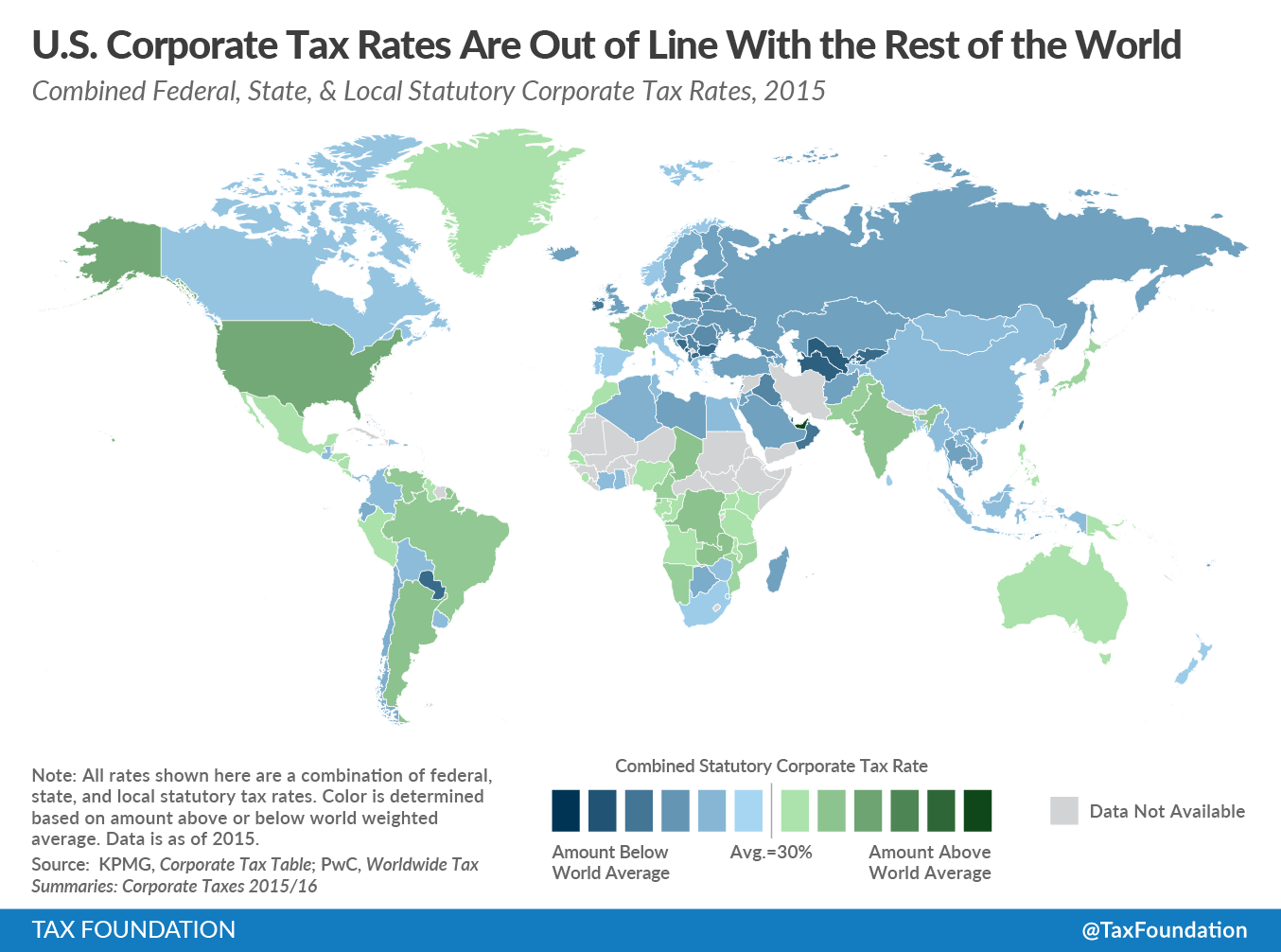

How The U S Corporate Tax Rate Compares To The Rest Of The World Tax Foundation

Average Appraisal Is Half Of A Percent Less Than Expected Rocket Mortgage Press Room Quicken Loans Home Refinance Home Appraisal