arizona estate tax exemption 2019

Final individual federal and state income tax returns each due by tax day of the year following the individuals death. In the Tax Cuts and Jobs Act the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025.

The fair market value of these items is used not necessarily what you paid for them or what their values were when you.

. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. The estate and gift tax exemption is. Please note that the next update of this compilation will not take place until after the conclusion of the 55th Legislature 2nd.

Ad Download Or Email AZ 5000 More Fillable Forms Register and Subscribe Now. Arizona also allows exemptions for the following. 2019 Arizona Revised Statutes Title 9 - Cities and Towns 9-625 Tax exemption.

Starting with the 2019 tax year Arizona allows a dependent credit instead of the dependent exemption. 2019 Arizona Revised Statutes Title 20 - Insurance 20-837 Tax exemption. The taxpayer or their spouse is 65 years old or older Each.

Ad Download Or Email AZ 5000 More Fillable Forms Register and Subscribe Now. If calling on a letter from 2018 it will be for the 2020 tax year. The standard deduction will match the Federal standard deduction for 2019 12200 singlemarried filing separate 18350 head of household 24400 married filing joint.

Even though Arizona does not have its own estate tax the federal government still imposes its own tax. Theres no exemption available for assessments in excess of 5000 according to the Arizona Department of Revenue and the same exemption amounts and thresholds apply to some veterans who arent disabled but two more rules apply in this case. The current federal estate tax is currently around 40.

The veteran must have served for at least 60 days during World War I or a previous war to qualify and he must also. Because Arizona conforms to the federal law there is no longer an estate tax in Arizona after January 2005. Property taxes in Arizona are imposed on both real and personal property.

You can also avoid the estate tax by gifting small amounts each year to your heirs. Removal of the personal and dependent exemption amounts. All organizations may file a Tax Exemption Claim Form with a Redemption of Waiver Form if the property was owned and operated by the non- profit between January 1.

It will be for the 2019 tax year. Ford AZ Court of Appeals 2-21-2019. Complete Edit or Print Tax Forms Instantly.

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. The Gift Tax Annual Exclusion remained the same between 2018 and 2019. There will now be a 100 child tax credit per dependent under 17 years of age and 25 for dependents 17 and older.

But that doesnt leave you exempt from a number of other necessary tax filings like the following. Residents and nonresidents owning property there can rejoice. The exemption will be phased in as follows.

Fortunately the estate tax credit creates an amount you can pass on to your heirs without being taxed. Every corporation doing business pursuant to this article is declared to be a nonprofit and benevolent institution and to be exempt from state county district municipal. Federal law eliminated the state death tax credit effective January 1 2005.

Arizona Case Law Property Tax Exemptions. The taxpayer or their spouse is blind. 15000 per person per person.

Getty The Internal Revenue Service announced today the official estate and gift tax limits for 2019. Annual Exclusion for Gifts. All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax.

The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. AZ Rev Stat 20-837 2019 20-837. If an estate is worth 15 million 36 million is taxed at 40 percent.

The following information accompanies a presentation Mike gave to members of the Arizona Commercial Mortgage Lenders Association ACMLA on March 12 2019. However the new tax plan increased that exemption to 1118 million for tax year 2018 rising to 114 million for 2019 1158 million for 2020 and now 117 million for 2021. The Arizona Revised Statutes have been updated to include the revised sections from the 55th Legislature 1st Regular Session.

For tax years prior to 2019 Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. Arizona Case Law Property Tax Exemptions. Gifts of less than the annual gift.

They disincentivize business investment and can drive high-net-worth individuals out-of-state. The Estate Tax is a tax on your right to transfer property at your death. This exemption rate is subject to change due to inflation.

There are no inheritance taxes or estate taxes in Arizona. Fall 2019 Arizona Case Law Affecting Commercial Real Estate and Lending December. Estate and inheritance taxes are burdensome.

An eligible city is regarded as performing a governmental function in carrying out the purposes of this chapter and the eligible project is considered to be municipal property for the purposes of article IX section 2 Constitution of Arizona. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. On May 31 2018 Connecticut changed its estate tax law to extend the phase-in of the exemption to 2023 to reflect the increase in the federal exemption to 10 million indexed for inflation in the 2017 Tax Act.

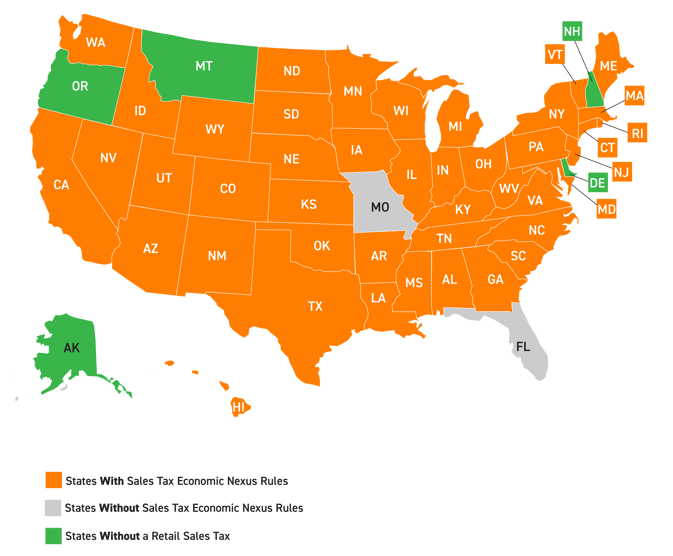

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

424b2 1 N1623 X17 424b2 Htm Final Prospectus Filed

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Arizona Inheritance Tax Waiver Form Fill And Sign Printable Template Online Us Legal Forms

Estate Planning Lehigh Valley Investment Group

Pointguard Advisors Network Home Facebook

Study Arizona A So So State For Retiree Taxes

Recent Changes To Estate Tax Law What S New For 2019

Mesa Bankruptcy Attorneys Affordable Mesa Bankruptcy Services Call